More About Insurance Solutions For Remote Workers

When persons listen to about child existence insurance insurance policies with versatile conditions, they normally pause and wonder if it really makes sense to think about insurance so early in everyday life. I get it, because childhood seems like a time that ought to be carefree, playful, and much far from economic preparing. Nevertheless, lifestyle incorporates a amusing way of peculiar us, and setting up ahead can feel like planting a tree that gives shade afterwards. These insurance policies are certainly not about expecting the worst, but about getting ready properly. They might provide peace of mind, long-term value, and a security Web that grows along with your child. When you think about it, giving your child a economical foundation early can feel like providing them a head start out in a lengthy race.

Among the biggest explanations moms and dads take a look at little one lifestyle coverage procedures with adaptable phrases would be the adaptability they provide. Existence modifications frequently, like a river that by no means flows the identical way 2 times. Versatile conditions indicate you are not locked into rigid principles that no longer in good shape All your family members predicament. You might start with a modest approach and adjust it later on as your earnings grows or as your son or daughter reaches new milestones. This overall flexibility can feel like aquiring a jacket that still matches even when the weather conditions alterations. Rather than scrambling to adjust later on, you have already got options crafted into the plan from the beginning.

A further angle truly worth exploring is how these guidelines can lock in insurability in a young age. Young ones are usually nutritious, and that will get the job done within your favor. With kid lifetime insurance policies policies with adaptable terms, you regularly protected protection prior to any health concerns arise. Think about it like reserving a seat at a favorite show right before it sells out. Later in life, if your son or daughter develops overall health ailments, they should still have usage of coverage that might normally be expensive or constrained. This factor by yourself is often comforting for parents who want to safeguard their baby foreseeable future solutions.

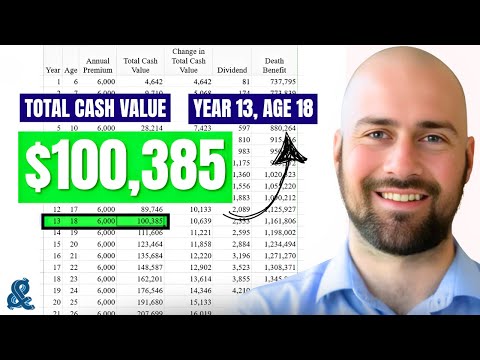

Folks also discuss the financial savings part That always includes kid life coverage insurance policies with adaptable conditions. Whilst not every plan performs the same way, some Develop hard cash price as time passes. This tends to come to feel similar to a silent financial savings account growing in the qualifications while you focus on everyday life. Over time, that money price may be useful for schooling, beginning a company, or managing unexpected expenses. It is not about finding wealthy speedily, but about continual progress. Like watching a plant increase, it demands patience, but the long run payoff can be meaningful.

How Insurance For Valuable Jewelry Collections can Save You Time, Stress, and Money.

There exists also an psychological facet to look at. Choosing baby everyday living coverage procedures with versatile conditions can provide parents a sense of Handle in an unpredictable earth. Parenting normally appears like juggling too many balls at once, and obtaining 1 considerably less get worried will make a big variance. Figuring out you have put a little something in place for your child long term can bring a peaceful perception of aid. It is comparable to buckling a seatbelt, not since you assume an accident, but because you value security and preparedness.

There exists also an psychological facet to look at. Choosing baby everyday living coverage procedures with versatile conditions can provide parents a sense of Handle in an unpredictable earth. Parenting normally appears like juggling too many balls at once, and obtaining 1 considerably less get worried will make a big variance. Figuring out you have put a little something in place for your child long term can bring a peaceful perception of aid. It is comparable to buckling a seatbelt, not since you assume an accident, but because you value security and preparedness.Some critics argue that oldsters need to emphasis on their own insurance coverage initially, and that time is not Improper. Nonetheless, child daily life insurance coverage policies with flexible terms do not have to compete with Grownup coverage. Instead, they could complement it. Imagine your family financial strategy for a puzzle, where each bit has its position. Grownup insurance plan handles cash flow alternative and residence balance, though baby guidelines focus on potential safety and possibility. Together, they might produce a much more total image that supports the whole family.

Yet another crucial aspect is affordability. Lots of mom and dad are amazed to discover that child lifestyle insurance policies guidelines with flexible phrases may be reasonably economical. Beginning early normally usually means lower premiums, which often can in good shape extra conveniently right into a every month funds. It truly is like purchasing a ticket early and shelling out a lot less than for those who waited until finally the last second. After some time, People little payments can insert as much as significant Added benefits. This affordability causes it to be easier for households from different money backgrounds to look at this feature.

Adaptability also extends to how much time the policy lasts. Boy or girl lifestyle coverage guidelines with flexible conditions may perhaps permit conversion to Grownup policies afterwards. This attribute can feel similar to a bridge involving childhood and adulthood, ensuring continuity of coverage. When your son or Unlock Info daughter grows up, they might not want to start from scratch. Rather, they are able to have forward a coverage which has been with them For a long time. This continuity is often Particularly beneficial through early adulthood, when funds is usually restricted and priorities remain forming.

Mothers and fathers often request if these procedures are genuinely required. That question is pure, and the answer relies on personalized values and aims. Child lifestyle insurance policies with versatile conditions are not a one particular sizing matches all solution. For a few family members, they make excellent perception, while others may perhaps choose various methods. What issues is knowing the options and building an knowledgeable selection. It can be like picking out the suitable Device for a occupation. You wish a thing that matches your needs, not precisely what Everybody else is applying.

Education and learning preparing is another place where by these policies can Perform a job. Some moms and dads make use of the dollars value from boy or girl life insurance plan policies with versatile terms to help fund university or teaching packages. When it mustn't switch other education price savings options, it may possibly function yet another useful resource. Think about it being a backup generator that kicks in when essential. Having a number of selections can lower tension and supply overall flexibility when massive bills get there.

There is certainly also the thought of training economical duty. By putting together youngster everyday living insurance policy insurance policies with versatile terms, mother and father can later involve their young children in knowing how the policy performs. This may be a gentle introduction to economic principles like preserving, desire, and long run setting up. It is comparable to educating a baby how to ride a motorbike, setting up with coaching wheels and guidance. After a while, they achieve self-confidence and expertise that will provide them very well into adulthood.

From a possibility management viewpoint, these insurance policies provide defense towards unusual but devastating functions. No father or mother wishes to think about dropping a baby, but acquiring boy or girl daily life insurance policies policies with flexible phrases might help cover medical costs, funeral fees, or time without work work Should the unthinkable transpires. It's not necessarily about putting a cost on the life, but about decreasing financial pressure in the course of an presently unpleasant time. In that feeling, the plan acts just like a cushion, softening the impression of a hard drop.

The 9-Minute Rule for Insurance For Artisans And Handmade Product Sellers

Some family members also enjoy the predictability these procedures provide. With little one daily life insurance coverage guidelines with flexible conditions, you often know What to anticipate with regards to rates and Gains. This predictability may make budgeting less difficult and decrease surprises. Lifetime is previously filled with unknowns, so acquiring just one region that feels stable is usually comforting. It truly is like having a trusted clock around the wall, usually ticking at the exact same rate.Cultural and personal beliefs also Participate in a role in how people look at youngster lifestyle coverage procedures with versatile conditions. In a few people, preparing forward is deeply ingrained, while some prefer to center on the current. Neither strategy is inherently right or wrong. What matters is aligning your choices together with your values. If you believe in developing a basic safety Web early, these insurance policies can align well with that attitude and help your long lasting vision for Your loved ones.